| |

| |

|

To the Stockholders:We will hold our 2012 annual meeting of stockholders at 9:00 a.m. on Monday, May 14, 2012 at our World Headquarters in Stamford, Connecticut.The Notice of Meeting and Proxy Statement and accompanying proxy card describe in detail the matters to be acted upon at the meeting.It is important that your shares be represented at the meeting. Whether or not you plan to attend, please submit a proxy to vote your shares through one of the three convenient methods described in this proxy statement. Your vote is important so please act at your first opportunity.We have elected to furnish proxy materials and the Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 2011, to many of our stockholders over the Internet pursuant to Securities and Exchange Commission rules. We urge you to review our Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 2011, as well as our Proxy Statement for information on our financial results and business operations over the past year and our strategy. The Internet availability of our proxy materials affords us an opportunity to reduce costs while providing stockholders the information they need. On or about March 23, 2012 we started mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and annual report and how to vote online along with instructions on how to receive a printed copy of the proxy statement and annual report. We provided a copy of the annual meeting materials to all other stockholders by mail or, if specifically requested, through electronic delivery.If you receive your annual meeting materials by mail, the Notice of Meeting and Proxy Statement, Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 2011 and proxy card are enclosed. Whether or not you plan to attend the annual meeting in person, please mark, sign, date and return your proxy card in the enclosed prepaid envelope, or submit your proxy to vote via telephone or the Internet, as soon as possible. If you decide to attend the annual meeting and wish to change your vote, you may do so by voting in person at the annual meeting. If you received your annual meeting materials via e-mail, the e-mail contains voting instructions and links to the proxy statement and annual report on the Internet, which are also available at www.proxyvote.com.We look forward to seeing you at the meeting.Murray D. MartinChairman, President andChief Executive OfficerStamford, ConnecticutMarch 23, 2012

NOTICE OF THE 2014 PITNEY BOWES INC. WORLD HEADQUARTERS 1 ELMCROFT ROAD STAMFORD, CONNECTICUT 06926-0700 (203) 356-5000 To the Stockholders: We will hold our 2014 annual meeting of stockholders at 9:00 a.m. on Monday, May 12, 2014 at our World Headquarters in Stamford, Connecticut. The Notice of Meeting and Proxy Statement and accompanying proxy card describe in detail the matters to be acted upon at the meeting. It is important that your shares be represented at the meeting. Whether or not you plan to attend, please submit a proxy through one of the three convenient methods described in this proxy statement in order for your shares to be voted at the meeting. Your vote is important so please act at your first opportunity. We have elected to furnish proxy materials and the Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 2013 to many of our stockholders via the Internet pursuant to Securities and Exchange Commission rules. We urge you to review those materials as well as our proxy statement for information on our financial results and business operations over the past year. The Internet availability of our proxy materials affords us an opportunity to reduce costs while providing stockholders the information they need. On or about March 27, 2014, we started mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and annual report and how to submit a proxy online along with instructions on how to receive a printed copy of the proxy statement and annual report. We provided a copy of the annual meeting materials to all other stockholders by mail or through electronic delivery. If you receive your annual meeting materials by mail, the Notice of Meeting and Proxy Statement, Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 2013 and proxy card are enclosed. Whether or not you plan to attend the annual meeting in person, please mark, sign, date and return your proxy card in the enclosed prepaid envelope, or submit your proxy via telephone or the Internet, as soon as possible in order for your shares to be voted at the meeting. If you decide to attend the annual meeting and wish to change your vote, you may do so by submitting a later dated proxy or by voting in person at the annual meeting. If you received your annual meeting materials via e-mail, the e-mail contains voting instructions and links to the proxy statement and annual report on the Internet, which are also available atwww.proxyvote.com. We look forward to seeing you at the meeting. Michael I. Roth Non-Executive Chairman of the Board Stamford, Connecticut Notice of Meeting: The annual meeting of stockholders of Pitney Bowes Inc. will be held on Monday, May 12, 2014, at 9:00 a.m. at the company’s World Headquarters, 1 Elmcroft Road, Stamford, Connecticut 06926-0700. Directions to Pitney Bowes’ World Headquarters appear on the back cover page of the proxy statement. Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on May 12, 2014: Pitney Bowes’ 2014 Proxy Statement and Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 2013, are available atwww.proxyvote.com. The items of business at the annual meeting are: Stockholders also will act on such other matters as may properly come before the meeting, including any continuation of the meeting caused by any adjournment or postponement of the meeting. March 14, 2014 is the record date for the meeting. This proxy statement and accompanying proxy card are first being distributed or made available via the Internet beginning on or about March 27, 2014. Amy C. Corn Corporate Secretary NOTICE: Your vote is important. Brokers TABLE OF CONTENTS Want Electronic Delivery of Annual Report and Proxy Statement Stockholder Proposals and Other Business for the Security Ownership of Directors and Executive OfficersNotice of Meeting:The annual meeting of stockholders of Pitney Bowes Inc. will be held on Monday, May 14, 2012, at 9:00 a.m. at the company’s World Headquarters, 1 Elmcroft Road, Stamford, Connecticut 06926-0700. Directions to Pitney Bowes’ World Headquarters appear on the back cover page of the proxy statement.Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on May 14, 2012:Pitney Bowes’ 2012 Proxy Statement and Annual Report to Stockholders, including the Report on Form 10-K for the year ended December 31, 2011, are available at www.proxyvote.com.The items of business at the annual meeting are:1.Election of 10 Directors named in the proxy statement.2.Ratification of the Audit Committee’s Appointment of the Independent Accountants for 2012.3.Advisory Vote to Approve Executive Compensation.4.Such other matters as may properly come before the meeting, including any continuation of the meeting caused by any adjournment of the meeting.March 16, 2012 is the record date for the meeting.This proxy statement and accompanying proxy card are first being distributed or made available via the Internet beginning on or about March 23, 2012.Amy C. CornCorporate Secretary

ANNUAL MEETING

AND

PROXY STATEMENT

March 27, 20141. Election of 10 directors named in the proxy statement. 2. Ratification of the Audit Committee’s Appointment of the Independent Accountants for 2014. 3. Advisory Vote to Approve Executive Compensation. 4. Approval of the Pitney Bowes Directors’ Stock Plan. banks and other nominees arenot permitted to vote on our proposals regarding the election of directors, or executive compensation and other matters to be considered at the meeting (except on ratification of the Audit Committee’s appointment of the Independent Accountants for 2014) without instructions from the beneficial owner. Your vote is important. Therefore, if your shares are held through a broker, bank or other nominee, please instruct your broker, bank or other nominee on how to vote your shares. Unless you provide instructionsFor your vote to your broker, banker or other nominee on how to vote your shares, your shares will not be votedcounted with respect to proposals 1, 3 or 3.4, you will need to communicate your voting decisions to your broker, bank, financial institution or other nominee.Page Page5 510 The Annual Meeting and Voting 10 510 510 510 510 510 510 611 611 611 611 720132015 Annual Meeting11 712 713 713 13 7713 814 814 914 915 15 101015 1016 16 101116 11Role of Governance Committee in Determining Director Compensation11111212121320 1420 14 Table21 1522 1622 1723 1723 1724 Vote Required 24 Nominees 24 3 Page 181819212

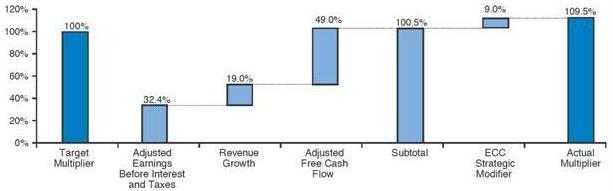

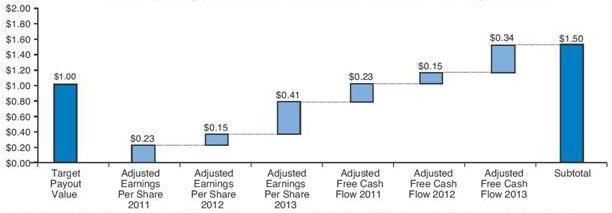

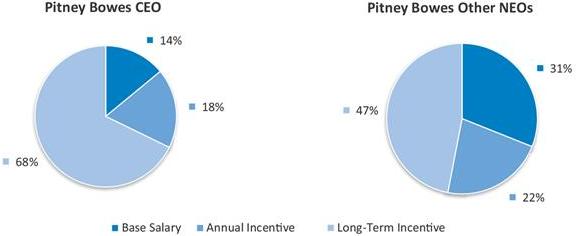

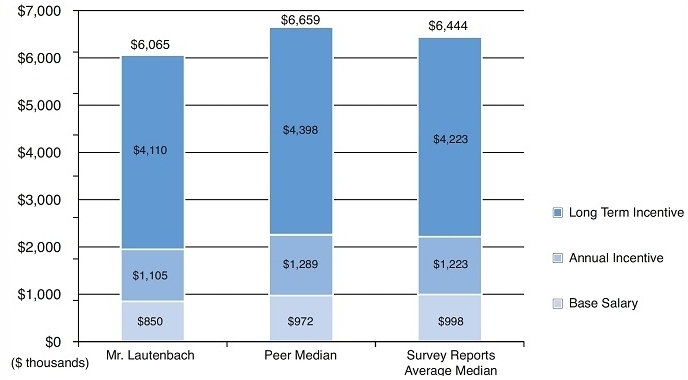

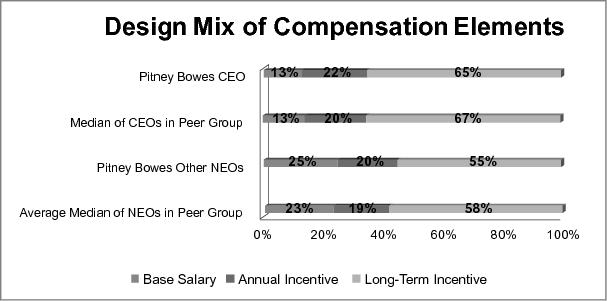

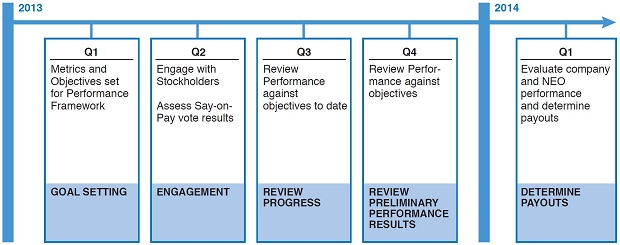

In this summary we highlight certain information contained elsewhere in this proxy statement. This is only a summary and does not contain all the information you should consider before you submit your proxy or vote. Please read the complete proxy statement and Annual Report on Form 10-K before you submit your proxy or vote. Annual Meeting Information Governance Structure and Leadership Roles The board reappointed Michael Roth, an independent member of the board of directors, to serve as Non-Executive Chairman of the Board in May 2013. A description of the Independent Chairman role appears in the Board of Directors Governance Principles, which can be found on the company’s website atwww.pb.com under the caption “Our Company—Leadership & Governance.” In December 2012, Marc Lautenbach became the company’s President and Chief Executive Officer. In his first year as President and CEO, Mr. Lautenbach focused on resetting the strategic direction of the company, assembling the right team to lead the company’s critical areas of development over the next several years and beginning to execute on initiatives consistent with the new strategies. 2013 Performance and Payout SUMMARY OF 2013 BUSINESS RESULTS In 2013, the company achieved significant success in executing on its strategy to transform the company for the future. This success was evidenced through our financial results and attainment of certain objectives targeted at longer-term success, including solidifying our balance sheet and divesting businesses no longer in line with the company’s long-term strategy. Our total shareholder return for the year was an extraordinary 132%, which placed us fifth in year-over-year total stockholder return among all S&P 500 companies for 2013. We believe the stock price increase reflected stockholder recognition that our first steps in executing on our new strategy to unlock the value embedded in our company were successful and position us well for the future. We identified three major objectives for the company that would determine our progress towards transforming our businesses and made significant progress on each. These objectives were as follows: (1) stabilize the mailing business; (2) achieve operational excellence and (3) invest in growth initiatives. PROXY SUMMARY SUMMARY OF 2013 COMPENSATION PAYOUTS Based on the 2013 financial results summarized above when compared against the pre-determined financial goals, the annual incentive payout multiplier for the named executive officers (NEOs) was 109.5% and the long-term 2011-2013 cash incentive award payout was $1.50. PROXY SUMMARY Summary of 2013 Executive Compensation Changes At the annual meeting in 2013, stockholders overwhelmingly approved our executive compensation (Say-on-Pay) with nearly 93% of votes cast in favor. The vote reflected stockholder approval for the compensation changes the Executive Compensation Committee adopted in late 2012 and early 2013 in connection with executive compensation. These actions included: Continuing to make improvements in the executive compensation structure in 2013, the Executive Compensation Committee adopted the following changes to further strengthen the alignment of executive compensation incentives with stockholder interests: We have a “pay-for-performance” philosophy that is the foundation of all decisions regarding compensation of our NEOs. With the changes approved by the Executive Compensation Committee and the independent board members, we have enhanced the link between pay and performance in the design of our executive compensation program. Please see “Compensation Discussion and Analysis” beginning on page 35 of this proxy statement for a more detailed discussion of the 2013 executive compensation awards and payouts. Direct Compensation Components and Mix For each NEO, the Executive Compensation Committee sets target total direct compensation levels (base salary plus annual and long-term incentives) so that the base salary, total cash compensation, and total direct compensation is at +/– 20% of the median for each position of the competitive data based on the Towers Watson Regressed Compensation Report, as regressed for companies approximately our size, and the Radford High-Tech Industry Survey focusing on companies with revenue scopes similar to ours (Survey Reports). NEO direct compensation is weighted toward variable compensation, where the actual amount earned may vary from the targeted amounts due to company performance. PROXY SUMMARY Meeting Agenda Items Proposal 1: Election of Directors You are being asked to elect 10 directors. Each of the directors is standing for election to a one-year term ending as of the next annual meeting of stockholders in 2015 and until his or her successor has been duly elected and qualified. All directors attended over 75% of the meetings of the board and board committees on which they served in 2013. Summary Information about our Director Nominees PROXY SUMMARY Proposal 2: Ratification of the Audit Committee’s Appointment of the IndependentAccountants for 2014 The board is asking stockholders to ratify the selection of PricewaterhouseCoopers LLP as our independent accountants for 2014. Proposal 3: Advisory Vote to Approve Executive Compensation The board is asking stockholders to approve, on an advisory basis, the compensation of the named executive officers as disclosed in this proxy statement. The board has determined to hold this advisory vote on an annual basis. The next advisory vote will be at the 2015 annual meeting of stockholders. The vote on executive compensation is an advisory vote and the results will not be binding on the board or Pitney Bowes Inc. The affirmative vote of the majority of the votes cast will constitute the stockholders’ non-binding approval with respect to our executive compensation programs. Abstentions and broker non-votes will not be votes cast and therefore will have no effect on the outcome of the vote. Proposal 4: Approval of the Pitney Bowes Directors’ Stock Plan The board is asking stockholders to approve the Directors’ Stock Plan. The plan will govern grants of stock-based awards to non-employee directors. The plan does not require the authorization of additional shares. All awards under the Directors’ Stock Plan will be satisfied from the shares approved in 2013 in connection with the 2013 Employee Stock Plan. Our board of directors is soliciting proxies to be used at the annual meeting of stockholders to be held on May An admission ticket, which is required for entry into the annual meeting, is attached to your proxy card if you hold shares directly in your name as a If your shares are held in the name of a bank, broker or nominee and you plan to attend the meeting, you must present proof of your ownership of Pitney Bowes stock as of the record date (such as a bank or brokerage account statement) to be admitted to the meeting. If you have received a Notice of Internet Availability of Proxy Materials (a “Notice”), your Notice is your admission ticket. If you plan to attend the annual meeting, please submit your proxy, but keep the Notice and bring it to the annual meeting. Stockholders also must present a form of photo identification, such as a driver’s license, in order to be admitted to the annual meeting.No cameras, recording equipment, large bags, or packages will be permitted in the annual meeting. Many cellular phones have built-in cameras, and, while these phones may be brought into the annual meeting, the camera function may not be used at any time. Record stockholders of Pitney Bowes common stock and $2.12 convertible preference stock at the close of business on March If you are a registered stockholder Alternatively, you may attend the meeting and vote in person. If you hold your shares through a broker, bank, trustee or other nominee, you are a beneficial owner and should refer to instructions provided by that entity on voting methods. May I revoke my proxy or change my vote? If you are a registered stockholder, you may revoke your proxy or change your vote at any time before your proxy is voted at the meeting by any of the following methods: Attendance at the meeting alone will not revoke your proxy. If you hold your shares through a broker, bank, trustee or other nominee, you are a beneficial owner and should refer to instructions provided by that entity on how to revoke your proxy or change your vote. The holders of shares representing a majority of the you will be considered part of the quorum. Abstentions and broker non-votes are included in the count to determine a quorum. If a quorum is present, director candidates receiving the affirmative vote of a majority of votes cast will be elected. Proposals 2, 3 and Your broker is not permitted to vote on your behalf on the election of directors, Under New York Stock Exchange rules, if your broker holds your shares in its “street” name, the broker may vote your shares in its discretion on proposal 2 if it does not receive instructions from you. GENERAL INFORMATION If your brokerdoes nothave discretionary voting authority and you do not provide voting instructions, or if you abstain on one or more agenda items, the effect would be as follows: Proposal 1: Election of Directors Broker non-votes and abstentions would not be votes cast and therefore would not be counted either for or against. As a result, broker non-votes Proposal 2: Ratification of Audit Committee’s Appointment of the If you choose to abstain in the ratification of the Audit Committee’s selection of the independent accountants for Proposal 3: Advisory Vote to Approve Executive Compensation The vote to approve executive compensation is an advisory vote and the results will not be binding on the board of directors or the company. The board of directors will review the results and take them into consideration when making future decisions regarding executive compensation. Proposal 4: Approval of the Pitney Bowes Inc. Directors’ Stock Plan Under our By-laws, broker non-votes and abstentions would not be votes cast and therefore would not be counted either for or against. As a result, broker non-votes and abstentions will have no effect on the vote on the Directors’ Stock Plan. However, for purposes of approval under New York Stock Exchange rules, abstentions are treated as votes cast, and, therefore, will have the same effect as an “against” vote, and broker non-votes are not considered votes cast, and, therefore, will have no effect on the outcome of the vote. How do Dividend Reinvestment Plan participants or employees with shares in the 401(k) plans vote by proxy? If you are a registered stockholder Shares held in Broadridge Financial Solutions, Inc. Only one Notice or, if paper copies are requested, only one proxy statement and annual report to stockholders including the report on Form 10-K are delivered to multiple stockholders sharing an address unless Similarly, any stockholder currently sharing an address with another stockholder but nonetheless receiving separate copies of the materials may request delivery of a single copy in the Requests can be made to: Broadridge Householding Department by phone at Broadridge Householding Department 51 Mercedes Way Edgewood, New York 11717. If you own shares of stock through a bank, broker, trustee or other nominee and receive more than one Investor Relations, Pitney Bowes Inc. 1 Elmcroft Road, MSC 63-02 Stamford, CT 06926-0700. Want Electronic Delivery of the Annual Report and Proxy We want to communicate with you in the way you prefer. You may During the Stockholder Proposals and Other Business for the If a stockholder wants to submit a proposal for inclusion in GENERAL INFORMATION meeting is more than 30 days before or more than 60 days after the anniversary of our 2014 annual meeting, then the stockholder’s notice must be delivered no earlier than the close of business on the 120th day prior to the meeting and no later than the close of business on the later of the 90th day prior to the meeting or, if the first public announcement of the date of the annual meeting is less than 100 days prior to the date of such meeting, the 10th day after the first public announcement of the meeting date. There are other procedural requirements in the By-laws pertaining to stockholder proposals and director nominations. The By-laws are posted on We encourage stockholders to visit Effective December 3, 2012, the board of directors separated the roles of Chairman and CEO. The board appointed Michael I. Roth, an independent director, as Non-Executive Chairman of the board of directors and reappointed him to this role in May 2013 for a term of one year. The board of directors believes it should have the flexibility to establish a leadership structure that works best for the company at a particular time, and was Mr. Roth’s role prior to his appointment as Non-Executive Chairman, were similar in most respects to those of a Non-Executive Chairman, this was an appropriate time to separate the roles of CEO and Chairman. The board of directors has established well-defined responsibilities, qualifications and selection criteria Among the board’s most important responsibilities is to oversee succession planning and leadership development. As part of this process, the Governance Committee oversees long-term and short-term plans for CEO succession. The board of directors is responsible for evaluating the performance of the In Periodically, but not less than annually, the board of directors 4

Time and Date: Monday, May 12, 2014 at 9:00 a.m. Place: Pitney Bowes World Headquarters

1 Elmcroft Road

Stamford, CT 06926-0700Requirements for

Attending the Meeting:Admission ticket, which is attached to your proxy card, or Notice of Internet Availability of Proxy Materials, together with a form of photo identification, such as a driver’s license. If your shares are held in the name of a bank, broker or nominee, you must present proof of your ownership as of the record date (such as bank or brokerage account statement). Record Date: March 14, 2014 Voting: Registered stockholders as of the record date (March 14, 2014) are entitled to submit proxies by Internet atwww.proxyvote.com; telephone at 1-800-690-6903; or completing your proxy card; or you may vote in person at the annual meeting. If you hold your shares through a broker, bank, trustee or other nominee, you are a beneficial owner and should refer to instructions provided by that entity on voting methods. • Stabilize the Mailing Business.The recurring revenue streams in 2013 for our global Mailing business continued to decline at a slower rate than in prior years contributing to the overall stabilization of the Mailing business. Equipment sales in the Production Mail and Small and Medium Business Solutions (SMB) segments improved and grew year-over-year. Our new go-to-market strategy implementation in the SMB business is improving our sales process and enhancing our client experience, while reducing costs. back cover• Achieve Operational Excellence.Our efforts in reducing expenses in 2013 resulted in a $71 million decline in selling, general and administrative expenses compared to the prior year. We are in the early stages of implementing a new 5 enterprise resource planning (ERP) system to streamline and consolidate many of our back-office operations. We signed a contract to sell our World Headquarters building in 2014. This is another example of our commitment to reducing operating expenses going forward. In addition, in 2013, we sold three businesses, Pitney Bowes Management Services (PBMS), International Mailing Services (IMS) and the Nordic furniture business. We sold these businesses because they did not fit within our future strategic intent for the company. We used the net proceeds from the sale of the North American portion of the PBMS sale to strengthen our balance sheet by redeeming $300 million in bonds originally scheduled to mature in 2014. Also in 2013, our clear focus on initiatives surrounding inventory and accounts receivables, two key components of working capital, generated over $100 million of cash improvements. • Invest in Growth Initiatives.In 2013, we continued to invest in our e-commerce business which grew revenue sequentially at a high double digit rate. In our software business, we brought in new leadership with skill sets to support our new go-to-market strategy, which we expect will bring revenue growth in the software business. Effective in 2014, we also increased our investment to 100%, in our high growth potential Brazilian joint venture by purchasing our joint venture partner’s interest in the business. 3

We urge stockholders to read our Annual Report on Form 10-K for the year ended December 31, 2013, filed with the Securities and Exchange Commission (SEC) on February 21, 2014, which describes our business and 2013 financial results in more detail.Funding of the 2013 Annual Incentive Pool and Payout Multiplier

The sum of the metrics may not exactly equal the total due to rounding. For additional detail on the calculation of the financial metrics shown in this chart please refer to the table on page 55 “Accounting Items and Reconciliation of GAAP to non-GAAP Measures.” 2013 Funding of the Cash Incentive Unit Pool and Payout Value

The amounts above include the impact of the Modifier for total shareholder return (TSR). The sum of the metrics may not exactly equal the total due to rounding. The amounts shown in the charts above are based on non-GAAP measures. For additional detail on the calculation of the financial metrics shown in this chart please refer to the table on page 55 “Accounting Items and Reconciliation of GAAP to non-GAAP Measures.” 6 • Reducing the CEO’s annual incentive target from 165% to 130% of base salary; • Enhancing the rigor and transparency of our annual incentive objectives; • Changing the mix of long-term incentives (LTI) to increase the performance-based component; • Enhancing the disclosure of performance targets; and • Eliminating excise tax gross-ups; • Changing the LTI mix beginning with 2014 grants to 100% equity, firmly placing the executive in the shoes of the stockholder with respect to LTI payouts; • Revising our peer group in light of the evolving strategic direction of the company, making more appropriate comparisons in the way we compensate our executives; • Increasing the weighting of financial metrics to 100% for the annual incentive program; • Utilizing as part of the LTI program a three-year cumulative TSR metric; • Expanding the executive stock ownership policy to include more senior executives, while at the same time, restricting shares that count toward the stockholding requirement; • Reducing severance benefits payable upon a change of control by one-third at most senior management levels; and • Introducing premium-priced stock options as a manner of making special compensatory awards.

The percentage in the above illustration is based on target compensation. Mr. Lautenbach’s long-term incentive amount includes the value of his one-time sign-on grant of premium-priced stock options. 7 Director

Nominee Age Director

Since Occupation Independent Committees Other Public

BoardsLinda G. Alvarado 62 1992 President and CEO, Alvarado Construction, Inc. X • Finance

•Governance 3M Company Anne M. Busquet 64 2007 Principal, AMB Advisors, LLC X • Executive Compensation

•Governance — Roger Fradin 60 2012 President and CEO, Honeywell Automation and Control Solutions, Honeywell International, Inc. X • Audit

•Finance MSC Industrial Direct Co., Inc. Anne Sutherland

Fuchs 66 2005 Consultant to private equity firms X • Audit

• Executive Compensation Gartner, Inc. S. Douglas

Hutcheson 58 2012 Former CEO, Leap Wireless International, Inc. X • Audit

•Finance — Marc B. Lautenbach 52 2012 President and CEO, Pitney Bowes Inc. • Executive — Eduardo R. Menascé 68 2001 Retired President, Enterprise Solutions Group, Verizon Communications Inc. X • Executive

•Executive Compensation**

• Governance John Wiley & Sons Inc., Hill-Rom Holdings, Inc., Hillenbrand, Inc. Michael I. Roth* 68 1995 Chairman and CEO,

The Interpublic Group of Companies, Inc. X • Audit

• Executive**

• Finance** Ryman Hospitality Properties Inc., The Interpublic Group of Companies, Inc. David L. Shedlarz 65 2001 Retired Vice Chairman, Pfizer Inc. X • Audit**

•Executive

• Finance Teachers Insurance and Annuity Association, The Hershey Company David B. Snow, Jr. 59 2006 Managing Partner and CEO, Cedar Gate Partners LLC X • Executive

•Executive

Compensation

• Governance** — * Non-Executive Chairman, Pitney Bowes Inc. ** Committee Chair 8 9 14, 2012,12, 2014, at 9:00 a.m. at the company’s World Headquarters, 1 Elmcroft Road, Stamford, Connecticut, and at any adjournment or postponement of the meeting. This proxy statement contains information about the items being voted on at the annual meeting.stockholder of record.registered stockholder. If you plan to attend the annual meeting, please submit your proxy but keep the admission ticket and bring it to the annual meeting.16, 201214, 2014 (the record date) can vote at the meeting. As of the record date, 200,204,924202,609,582 shares of Pitney Bowes common stock and 24,12720,853 shares of $2.12 convertible preference stock were issued and outstanding. Each stockholder has one vote for each share of common stock owned as of the record date, and 16.53 votes for each share of $2.12 convertible preference stock owned as of the record date.(whichwhich means you hold shares in your name),name, you may choose one of three methods to grant your proxy to have your shares voted: (i) you may grant your proxy on-line via the Internet by accessing the following website and following the instructions provided: www.proxyvote.com; (ii) you may grant your proxy by telephone (1-800-690-6903); or (iii) • you may grant your proxy on-line via the Internet by accessing the following website and following the instructions provided:www.proxyvote.com; • you may grant your proxy by telephone (1-800-690-6903); or (i) you may send in a revised proxy dated later than the first proxy; (ii) you may vote in person at the meeting; or (iii) you may notify the corporate secretary in writing prior to the meeting that you have revoked your proxy. • you may send in a revised proxy dated later than the first proxy; • you may vote in person at the meeting; or • you may notify the corporate secretary in writing prior to the meeting that you have revoked your proxy. sharesvotes entitled to votebe cast at the annual meeting constitutes a quorum. If you submit your proxy by Internet, telephone or proxy card,534 will be approved if a quorum is present and a majority of the votes cast by the stockholders are voted for the proposal.Brokers, banks and other nominees areor on executive compensation and other matters withoutto be considered at the stockholders meeting (except on ratification of the selection of PricewaterhouseCoopers LLP as auditors for 2014), unless you provide specific instructions fromby completing and returning the beneficial owner, as discussed in more detail below. Your vote is important. Therefore, if your shares are held through a broker, bankvoting instruction form or other nominee, please instruct your broker, bank or other nominee on howfollowing the instructions provided to you to vote your shares. Unlessstock via telephone or the Internet. If you provide instructions to your broker, banker or other nominee on how to votedo not own your shares of record, for your shares will notvote to be votedcounted with respect to proposals 1, 3 or 3.4, you will need to communicate your voting decisions to your broker, bank, financial institution or other nominee.10 wouldand abstentions will have no effect. If you choose to abstaineffect in the election of directors,directors.abstention will have no effect.Independent Accountants for 2014Proposal 2:2012,2014, the abstention will have no effect.If you choose to abstain, the abstention will have no effect. Broker non-votes and abstentions would not be votes cast and therefore would not be counted either for or against. As a result, broker non-votes wouldand abstentions will have no effect.effect on the advisory vote on executive compensation. of record and participate in the company’sour Dividend Reinvestment Plan, or the company’sour employee 401(k) plans, your proxy includes the number of shares acquired through the Dividend Reinvestment Plan and/or credited to your 401(k) plan account.the company’sour 401(k) plans are voted by the plan trustee in accordance with voting instructions received from plan participants. The plans direct the trustee to vote shares for which no instructions are received in the same proportion (for, against or abstain) indicated by the voting instructions given by participants in the plans.(“Broadridge”)(Broadridge) will tabulate the votes and act as Inspector of Election.Multiple Copies of Annual Report to StockholdersIn addition to furnishing proxy materials over the Internet, the company takes advantageWant more copies of the Securities and Exchange Commission’s “householding” rules to reduce the delivery cost of materials. Under such rules, onlyproxy statement? Getting too many copies?the company has received contrary instructions from one or more of the stockholders. If a stockholder sharing an address wishesstockholders give us contrary instructions. You may request to receive a separate Notice or copy of the proxythese materials, heeither now or she may so request by contacting Broadridge Householding Department by phone at 1-800-579-1639 or by mail to Broadridge Householding Department, 51 Mercedes Way, Edgewood, New York 11717. A separate copy will be promptly provided following receipt of a stockholder’s request, and such stockholder will receive separate materials in the future. Anyfuture, and we will promptly deliver the requested materials.future by contacting future.the number1-800-579-1639 or address shown above.Additional copies of our annual report to stockholders, including the report on Form 10-K or proxy statement will be sent to stockholders free of charge upon written request to Investor Relations, Pitney Bowes Inc., 1 Elmcroft Road, MSC 63-02, Stamford, CT 06926-0700.by mail to:Pitney Bowes annual report,copy of the materials, please contact that entity to eliminate duplicate mailings.6

Additional copies of our annual report to stockholders, including the report on Form 10-K or the proxy statement will be sent to stockholders free of charge upon written request to:StatementStatement?This proxy statement and our 2011 annual reportbe viewed online at www.proxyvote.com. If you are a stockholder of record and receivechoose to receive:• a full set of printed materials, including the proxy statement, annual report and proxy card; or • an email with instructions for how to view the annual meeting materials and vote online. annual meeting material by mail,voting season, you can elect to receiveselect the method of delivery for the future annual reports and proxy statements electronically or by following the instructions provided ifwhen you grant your proxy by Internetvote online or by telephone. If you choose this option,to receive the annual meeting materials electronically, you will receive an e-mail for future meetings listing the website locations of these documents and your choice will remain in effect until you notify us that you wish to resume mail delivery of these documents. If you hold your Pitney Bowes stock through a bank, broker, trustee or other nominee, you should refer to the information provided by that entity for instructions on how to elect this option. This proxy statement and our 2013 annual report may be viewed online atwww.proxyvote.com.20132015 Annual Meetingthe company’sour proxy material for the 20132015 annual meeting, which is scheduled to be held on Monday, May 13, 2013,11, 2015, it must be received by the corporate secretary by the close of business on November 23, 2012.27, 2014. Also, under our By-laws, a stockholder can present other business at an annual meeting, including the nomination of candidates for director, only if written notice of the business or candidates is received by the corporate secretary byno earlier than the close of business on January 12, 2015 and no later than the close of business on February 13, 2013.11, 2015. However, in the event that the date of the 2015 annual11 the company’sour Corporate Governance website atwww.pb.com under the caption “Our Company-LeadershipCompany—Leadership & Governance.” If notice of a matter is not received within the applicable deadlines or does not comply with the By-laws, the chairman of the meeting may refuse to introduce such matter. If a stockholder does not meet these deadlines, or does not satisfy the requirements of Rule 14a-4 of the Exchange Act, the persons named as proxies will be allowed to use their discretionary voting authority when and if the matter is raised at the annual meeting.Stockholders are encouragedthe company’sour Corporate Governance website atwww.pb.com under the caption “Leadership“Our Company—Leadership & Governance” for information concerning the company’s governance practices, including the Governance Principles of the Board of Directors, charters of the committees of the board, and the directors’ Code of Business Conduct and Ethics. The company’sOur Business Practices Guidelines, which is the company’s Code of Ethics for employees, including the company’s chief executive officerour Chief Executive Officer and chief financial officer,Chief Financial Officer, is also available on the company’sour Leadership & Governance website. We intend to disclose any future amendments or waivers to certain provisions of the directors’ Code of Business Conduct and Ethics or the Business Practices Guidelines on our website within four business days following the date of such amendment or waiver.Key Corporate Governance Practices Enhancing the Board’s Independent Leadership,

Accountability and Oversight• Separate Chairman and CEO.Our Governance Principles include well-defined responsibilities, qualifications and selection criteria with respect to the Chairman role. The board has appointed Michael I. Roth, an independent director, as Non-Executive Chairman. • Independent Committees.The board of directors determined that all board committees, other than the Executive Committee, should consist entirely of independent directors. • Executive Sessions.At each regular board meeting, our independent directors meet without the CEO or other members of management present to discuss issues, including matters concerning management. The Non-Executive Chairman presides at these executive sessions. • Majority Voting in Director Elections.Our By-Laws provide that in uncontested elections, director nominees must be elected by a majority of the votes cast. • Annual Election of Directors.Our By-Laws provide that our stockholders elect all directors annually. • Stock Holding Requirements.Under the current Directors’ Stock plan, restricted stock awards may not be transferred or sold, subject to limited exceptions, until the later of (i) termination of service as a director, or, if earlier, the date of a change of control (as defined in the Directors’ Stock Plan), and (ii) the expiration of the six-month period following the grant of such shares. • No Hedging or Pledging.Directors may not pledge or transfer for value Pitney Bowes securities, engage in short-term speculative (“in and out”) trading in Pitney Bowes securities, or participate in hedging and other derivative transactions, including short sales, “put” or “call” options, swaps, collars or similar derivative transactions, with respect to Pitney Bowes securities. 12 can reviewit reviews that structure from time to time. The company’s chief executive officer also serves astime, including in the chairmancontext of the board of directors.a change in leadership. The board decided that, with the election of directors has a Lead Director who is an independent member of the board of directors. In determining the appropriate leadership structure, the board of directors considered a number of factors, including the effectiveness of the role of independent Lead Director, the candorMr. Lautenbach as CEO, and dynamics of discussion among the directors and between directors and management, the facility with which directors influence the content of board meeting agendas, and the significance attributed by the company’s external constituents in the worldwide postal marketsdue to the title of chairman.The board of directors believesfact that the leadership structure it has chosen for Pitney Bowes is appropriate in light of the constructive and candid nature of the discussion at board and committee meetings, as well as the directors’ freedom to participate in the agenda-setting process, the directors’ access to members of senior management outside the presence of the chief executive officer, and the robust roleresponsibilities of the Lead Director.Director, whichand term and term limits with respect to the position of Lead Director.Chairman role. This information is set forth in detail in the Governance Principles of the Board of Directors, which can be found on the company’sour website atwww.pb.com under the caption “Our Company-LeadershipCompany—Leadership & Governance.” A descriptionLead Director responsibilitiesCEO and characteristics appears below. Additional information may be found infor selection of successors to that position. The criteria used when assessing the qualifications of potential CEO successors include, among others, strategic vision and leadership, operational excellence, financial management, executive officer leadership development, ability to motivate employees, and an ability to develop an effective working relationship with the board. The Governance Principles of the Board of Directors.Directors, which are posted on the company’s website atwww.pb.com under the caption “Our Company—Leadership & Governance,” include additional information about succession planning.May 2008,late 2012, the board used the succession planning process described above to plan for the succession from our former CEO to the hiring of our new President and CEO, Mr. Lautenbach, and to the appointment of a new Non-Executive Chairman of the board, Michael I. Roth.appointed James Keyes, oneconsiders management’s recommendations concerning succession planning for senior management roles other than the role of the independent directors, to serve as the board’s Lead Director for an initial termCEO. As part of two years. In May 2010 and May 2011,this process, the board reviews development plans to strengthen and supplement the skills and qualifications of directors appointed Mr. Keyes to serve as Lead Director for additional one-year terms. In February 2012, the board appointed Michael Roth to serve as Lead Director for an initial term of two years.internal succession candidates.Responsibilities and Characteristics of the Lead DirectorThe Lead Director chairs meetings of the board of directors in executive session; acts as chairman of the board in situations where the chairman and chief executive officer is unable to serve in that capacity; briefs the chief executive officer, as needed, following7

Role of the Board of Directors in Risk Oversight The board of Upon the recommendation of the Governance Committee, committee as described in its charter or the nature of the enterprise risk warranting review by the full board. For example, the Finance Committee oversees risks relating to liquidity and the Audit Committee oversees risks relating to internal controls. Each enterprise risk and its related mitigation plan is reviewed by either the board of directors or the designated board committee on an annual basis. The Audit Committee is responsible for overseeing and reviewing on an ongoing basis the overall process by which management identifies and manages Management monitors the CORPORATE GOVERNANCE The board of directors conducts an annual review of the independence of each director under the New York Stock Exchange listing standards and Based upon its review, the board of directors has concluded in its business judgment that the following directors are independent: In discussions by the board in executive session; reviews, revises, and provides comment, as appropriate, concerning proposed agendas for meetings of the board of directors; reviews and provides comment, as appropriate, on draft minutes of board of directors meetings prior to their distribution to the full board; communicates informally with the other directors between meetings of the board to foster free and open dialog among directors; reviews and responds, as appropriate, in accordance with guidelines established by the board of directors to communications from stockholders and other interested parties; partners with the Chair of the Governance Committee to provide performance and other feedback to the chief executive officer following the annual joint meeting of the Governance and Executive Compensation Committees; and partners with the Chair of the Executive Compensation Committee to provide compensation information to the chief executive officer following meetings of the board of directors where compensation action is taken with respect to the chief executive officer.The Lead Director must exhibit the following characteristics and skills: diplomacy, sound judgment, the ability to work collaboratively, to communicate effectively, with clarity and candor, and to recognize and act in accordance with an appropriate balance between (i) active mentor to the chief executive officer and communications aide to the board of directors, and (ii) maintaining an oversight (rather than management) perspective as a member of the board of directors. the directors is responsible for oversight of the company’s risk assessment and risk management process. Management is responsible for risk management, including identification and mitigation planning. The company established the enterprise risk management process was established to identify, assess, monitor and address risks across the entire company and its business operations. The description, assessments, mitigation plan and status for each enterprise risk are developed and monitored by management, including management “risk owners” and an oversight management risk committee.Oversight responsibility for each of the company’s identified enterprise-wide risks is assigned, uponand approval by the board of directors assigns oversight responsibility for each of the identified enterprise-wide risks to either a specific committee of the board, or to the full board. In addition to the board, each committee, with the exceptionsexception of the Executive Committee and the Executive Compensation Committee, is responsible for oversight of one or more of the company’s risks. Where possible, theThe assignments are generally made based upon in each case, the type of enterprise risk and the linkage of the subject matter to the responsibilities of thethe company’s risks. On an annual basis the board of directors receives a report on the status of all enterprise risks and their related mitigation plans. company’s risks and determines, from time to time, whether new risks should be considered either due to changes in the external environment, changes in the company’s business, or for other reasons. Management also determines whether previously identified risks should be combined with new or emerging risks.The process for the board’s oversight of mitigation of the company’s enterprise risks was developed by the Governance Committee and presented to the board of directors for review and adoption and is reviewed and updated as appropriate from time to time.13 theour standards of independence, which are set forth in the Governance Principles of the Board of Directors which are available on the company’sour website atwww.pb.com under the caption “Our Company-LeadershipCompany—Leadership & Governance.” In making these determinations, the board of directors considers, among other things, whether any director has had any direct or indirect material relationship with Pitney Bowes or its management, including current or past employment with Pitney Bowes or its independent accountants by the director or the director’s immediate family members.Rodney C. Adkins, Linda G. Alvarado, Anne M. Busquet, Roger Fradin, Anne Sutherland Fuchs, James H. Keyes,S. Douglas Hutcheson, Eduardo R. Menascé, Michael I. Roth, David L. Shedlarz, and David B. Snow, Jr. and Robert E. Weissman.making this determination,addition, the board of directors consideredpreviously determined that inRodney C. Adkins, James H. Keyes and Robert E. Weissman, who served on the ordinary course of business, transactions may occur betweenboard until May 2013, were independent. Marc B. Lautenbach is not independent because he is a Pitney Bowes and its subsidiaries and companies or other entities at which some of our directors are executive officers. Under the company’s independence standards, business transactions meeting the following criteria are not considered to be material transactions that would impair a director’s independence:officer.The director is an employee or executive officer of another company that does business with Pitney Bowes and our annual payments to or from that company in each of the last three fiscal years are in8

Communications with the Board of Directors Stockholders and other interested parties may communicate with the The board of directors has instructed the corporate secretary to assist the (i) Customer, vendor or employee complaints or concerns are investigated by management and copies are forwarded to the If any complaints or similar communications regarding accounting, internal accounting controls or auditing matters are received, they will be forwarded by the corporate secretary to the General Auditor and to the Audit Committee chair for review and copies will be forwarded to the Chairman. Any such matter will be investigated in accordance with the procedures established by the Audit Committee; and (iii) Other communications raising matters that require investigation will be shared with appropriate members of management in order to permit the gathering of information relevant to the directors’ review, and will be forwarded to the director or directors to whom the communication was addressed. Except as provided above, the corporate secretary will forward written communications to the full board of directors or to any individual director or directors to whom the communication is directed unless the communication is threatening, illegal or similarly inappropriate. Advertisements, solicitations for periodical or other subscriptions, and other similar communications generally will not be forwarded to the directors. Board Committees and Meeting Attendance During Members of the board of directors serve on one or more of the five standing committees described below. As the need arises, the board may establish ad hoc committees of the board to consider specific issues. Mr. The members of all other board committees are independent directors pursuant to New York Stock Exchange independence standards. Each committee of the board operates in accordance with a charter. The members of each of the board committees are set forth in the following chart. It is the CORPORATE GOVERNANCEan amount less than the greater of $1 million or two percent of the annual consolidated gross revenues of the company by which the director is employed.During 2011, Messrs. Adkins, Fradin, Roth, and Snow were employed at corporations with which Pitney Bowes engages in ordinary course of business transactions.We reviewed all transactions with each of these entities and determined these transactions were made in the ordinary course of business and were below the threshold set forth in our director independence standards referenced above.The board of directors has established procedures by which stockholdersLead Director,Non-Executive Chairman of the Audit Committee chair, the independent directors, or the board. Such parties may communicate with the Lead Directorboard via e-mail at lead.director@pb.com, withboardchairman@pb.com, the Audit Committee chair via e-mail at audit.chair@pb.com or they may write to one or more directors, care of the Corporate Secretary, Pitney Bowes Inc., 1 Elmcroft Road, MSC 65-19, Stamford, CT 06926-0700.Lead Director, theNon-Executive Chairman, Audit Committee chair and the board in reviewing all electronic and written communications, as described above, as follows:Lead Director;(ii) (ii) to the Audit Committee chair for review and copies will be forwarded to the Lead Director.It is the longstanding practice and the policy of the board of directors that the directors attend the annual meeting of stockholders. All but one director attended the May 2011 annual meeting.2011,2013, each director attended at least 75% of the total number of board meetings and meetings held by the board committees on which he or she served. The board of directors met seventen times in 2011,2013, and the independent directors met in executive session, without any member of management in attendance, sixseven times.Martin serves as the chairLautenbach is a member of the Executive Committee. Asneed arises,longstanding practice and the board may establish ad hoc committeespolicy of the board to consider specific issues.of directors that the directors attend the annual meeting of stockholders. All directors attended the May 2013 annual meeting.14 9

Name Audit Executive Executive Finance Governance Rodney C. Adkins X X Linda G. Alvarado X X Anne M. Busquet X X Roger Fradin X X Anne Sutherland Fuchs X X James H. Keyes X X Murray D. Martin X * Eduardo R. Menascé X X* X Michael I. Roth X X X * David L. Shedlarz X * X X David B. Snow, Jr. X X X* Robert E. Weissman X X Number of meetings in 2011 6 0 7 5 5 Rodney C. Adkins, James H. Keyes and Robert E. Weissman served on the Executive Compensation Committee The Audit Committee monitors internal accounting controls and the scope and results of The board of directors has determined that the following members of the Audit Committee, S. Douglas Hutcheson, Michael I. Roth and David L. Shedlarz are “audit committee financial experts,” as that term is defined by The Executive Committee can act, to the extent permitted by applicable law and the company’s Restated Certificate of Incorporation and its The Executive Compensation Committee is responsible for ficers. The committee also recommends the “Compensation Discussion and Analysis” for inclusion in CORPORATE GOVERNANCE The Finance Committee reviews financial condition, reviewing and board approval major investment decisions including financing, mergers and acquisitions, divestitures and overseeing the financial operations of The Governance Committee recommends nominees for election to the board of directors, The Governance Committee generally identifies qualified candidates for nomination for election to the board of directors from a variety of sources, including other board members, management and stockholders. The committee also may retain a third-party search firm to assist the committee members in identifying and evaluating potential nominees to the board of directors. Stockholders wishing to recommend a candidate for consideration by the Governance Committee may do so by writing to vote at the meeting; (iv) a statement in support of the stockholder’s recommendation, including a description of the candidate’s qualifications; (v) information regarding the candidate as would be required to be included in a proxy statement filed in accordance with the rules of the The Governance Committee evaluates candidates If the Governance Committee believes that a potential candidate may be appropriate for recommendation to the board of directors, there is generally a mutual exploration process, during which the committee seeks to learn more about the candidate’s qualifications, background and interest in serving on the board of directors, and the candidate has the opportunity to learn more about the company, the board, and its governance practices. The final selection of the board’s nominees is within the sole discretion of the board of directors. Alternatively, as referenced on page Directors’ During The for their out-of-pocket expenses incurred in attending board and committee meetings. The board of directors maintains directors’ stock ownership guidelines, requiring, among other things, that each director accumulate and retain a minimum of 7,500 CORPORATE GOVERNANCE shares of Stock Plan” below. All members of the board of directors are in compliance with these guidelines. The directors’ stock ownership guidelines are available on Under the Directors’ Stock Plan, in rector effecting the disposition had accumulated and will retain 7,500 shares of common stock. Permitted dispositions are limited to: (i) transfer to a family member or family trust or partnership; and (ii) donations to charity after the expiration of six months from date of grant. The original restrictions would continue to apply to the donee except that a charitable donee would not be bound by the restriction relating to termination of service from the board of directors. Shares shown in the table on page Directors’ Deferred Incentive Savings We maintain a Directors’ Deferred Incentive Savings Plan under which directors may defer all or part of the cash portion of their compensation. Deferred amounts will be notionally “invested” in any combination of eral institutional investment funds. The investment choices available to directors under this plan are the same as those offered to employees under the company’s 401(k) plan. Directors’ Retirement The Linda G. Alvarado is the only current director who is eligible to receive a retirement benefit under the plan after termination of service on the board of directors. the date the plan was frozen, she had completed five years of service as a director, the minimum years of service required to receive an annual retirement benefit of 50% of her retainer as of CORPORATE GOVERNANCE DIRECTOR COMPENSATION FOR Each non-employee director receives an annual retainer of $65,000 ($16,250 per quarter) and a meeting fee of $1,500 for each board and committee meeting attended. Committee chairs (except for the Audit Committee chair) receive an additional $1,500 for each committee meeting that they chair, and the Audit Committee chair receives an additional $2,000 for each Audit Committee meeting chaired.

Compensation Name Audit Executive Executive

Compensation(1) Finance Governance Linda G. Alvarado X X Anne M. Busquet X X Roger Fradin X X Anne Sutherland Fuchs X X S. Douglas Hutcheson X X Marc B. Lautenbach X Eduardo R. Menascé X Chair X Michael I. Roth X Chair Chair David L. Shedlarz Chair X X David B. Snow, Jr. X X Chair Number of meetings in 2013 6 0 11 4 6 *ChairTheAudit Committeetheour financial reporting standards and practices of the company and the company’sour internal financial controls to confirm compliance with the policies and objectives established by the board of directors and oversees the company’sour ethics and compliance programs. The committee appoints independent accountants to conduct the annual audits, and discusses with the company’sour independent accountants the scope of their examinations, with particular attention to areas where either the committee or the independent accountants believe special emphasis should be directed. The committee reviews the annual financial statements and independent accountant’s report, invites the independent accountant’s recommendations on internal controls and on other matters, and reviews the evaluation given and corrective action taken by management. It reviews the independence of the independent accountants and approves their fees. It also reviews the company’s ourthe company’sour internal auditing activities, and submits reports and proposals on these matters to the board. The committee is also responsible for overseeing the process by which management identifies and manages the company’s risks. The committee meets in executive session with the independent accountants and internal auditor at each committee meeting.regulation of the Securities and Exchange Commission.SEC. All audit committeeAudit Committee members are independent as independence for audit committee members is defined in the New York Stock Exchange standards.TheExecutive CommitteeBylaws,By-laws, on matters concerning management of the business which may arise between scheduled board of directors meetings and as described in the committee’s charter.TheExecutive Compensation Committeethe company’sour executive compensation policies and programs. The committee chair frequently consults with, and the committee periodically meets in executive session with, Frederic W. Cook & Co., (“FWC”),Pay Governance LLC, its outsideindependent compensation consultant. The committee recommends to all of the independent directors for final approval policies, programs and specific actions regarding the compensation of the chairman and the chief executive officer,CEO, and approves the same for all of theour other executive officers of the company.of-the company’sour proxy statement, in accordance with the rules and regulations of the Securities and Exchange Commission,SEC, and reviews and approves allocations of sharesstock grants and other stock-based compensation awards. All Executive Compensation Committee members are independent as independence for compensation committee members is defined in the company’s employee stock plans in connection with the granting of stock and other stock based awards.New York Stock Exchange standards.15 TheFinance Committeethe company’sour financial condition and capital structure, and evaluates significant financial policies and activities, oversees the company’sour major retirement programs, advises management and recommends financial action to the board of directors. The committee’s duties include monitoring the company’sour current and projected10approvingrecommending forthe company’sour retirement plans. The committee recommends for approval by the board of directors the establishment of new plans and any amendments that materially affect cost, benefit coverages, or liabilities of the plans.TheGovernance Committeedetermines the duties of and recommends membership in, and functions of, the board committees, reviews executives’ potential for growth, reviews and recommends to the board of directors the amount and form of compensation to non-employee members of the board, and, with the Lead DirectorNon-Executive Chairman and the chief executive officer,CEO, is responsible for CEO succession planning and ensuring management continuity. The Governance Principles of the Board of Directors, which are posted on the company’sour website atwww.pb.com under the caption “Our Company-LeadershipCompany—Leadership & Governance,” include additional information about succession planning. The committee reviews and evaluates the effectiveness of board administration and its governing documents, and reviews and monitors company programs and policies relating to directors. The committee reviews related-person transactions in accordance with company policy.to theto: c/o Corporate Secretary, Pitney Bowes Inc., 1 Elmcroft Road, MSC 65-19, Stamford, CT 06926-0700. Recommendations submitted for consideration by the committee in preparation for the 20132015 annual meeting of stockholders must be received by January 2, 2013,5, 2015, and must contain the following information: (i) the name and address of the stockholder; (ii) the name and address of the person to be nominated; (iii) a representation that the stockholder is a holder of the company’sour stock entitledSecurities and Exchange Commission;SEC; and (vi) the candidate’s written, signed consent to serve if elected.recommended by stockholders recommend based on the same criteria it uses to evaluate candidates from other sources. The Governance Principles of the Board of Directors, which are posted on the company’sour Corporate Governance website atwww.pb.com under the caption “Our Company-LeadershipCompany—Leadership & Governance,” include a description of director qualifications. A discussion of the specific experience and qualifications identified by the committee identified for directors and nominees may be found under “Director Qualifications” on page 1723 of this proxy statement.711 of this proxy statement, stockholders intending to nominate a candidate for election by the stockholders at the meeting must comply with the procedures in Article II,I, Section 65 of the company’s By-laws. The By-laws are posted on the company’sour Corporate Governance website atwww.pb.com under the caption “Our Company-LeadershipCompany—Leadership & Governance.”Role of Governance Committee in Determining Director Compensation.In accordance with the Governance Principles of the Board, the Governance Committee reviews and recommends to the board of directors the amount and form of compensation to non-employee members of the board of directors. The Governance Committee reviews the director compensation policy periodically and may consult from time to time with a compensation consultant, selected and retained by the committee, as to the competitiveness of the program. The following is a summary of the director compensation program.Fees.Fees2011,2013, each director who was not an employee of the company received an annual feeretainer of $65,000 and a meeting fee of $1,500 for each board and committee meeting attended. Committee chairs (except for the Audit Committee chair) receive an additional $1,500 for each committee meeting that they chair, and the Audit Committee chair receives an additional $2,000 for each Audit Committee meeting chaired.Lead DirectorNon-Executive Chairman receives an additional annual retainer of $10,000.$50,000. All directors are reimbursed1116 companyour common stock within five years of becoming a director of Pitney Bowes. The stock ownership guidelines provide limited exceptions for the transfer of these shares while the director continues to serve on our board, as discussed in more detail under “Directors’the company’sour Corporate Governance website atwww.pb.com under the caption “Our Company-LeadershipCompany—Leadership & Governance.”20112013 each director who was not an employee of the company received an award of 2,200 shares of restricted stock which are fully vested uponafter six months from the date of grant. (Directors appointed by the board to fill a vacancy during the year receive a prorated grant of shares as described in the Directors’ Stock Plan.) The shares carry full voting and dividend rights upon grant but, unless certain conditions are met, may not be transferred or alienatedsold until the later of (i) termination of service as a director, or, if earlier, the date of a change of control (as defined in the Directors’ Stock Plan), and (ii) the expiration of the six-month period following the grant of such shares. The Directors’ Stock Plan permits certain dispositions of stock granted under the restricted stock program provided that the directordi-Ownership of shares granted under the Directors’ Stock Plan is reflected1521 of this proxy statement showingdisclosing security ownership of directors and executive officers.officers include shares granted to the directors under the Directors’ Stock Plan.Plan.The company maintainsPlanseveralsev- Deferral elections made with respect to plan years prior to 2004 also included as an investment choice the ability to invest in options to purchase common stock of the company.Stock options selected by directors as an investment vehicle for deferred compensation were granted through the Directors’ Stock Plan. The Directors’ Stock Plan permits the exercise of stock options granted after October 11, 1999 during the full remaining term of the stock option by directors who have terminated service on the board of directors, provided that service on the board is terminated: (i) after ten years of service on the board; (ii) due to director’s death or disability; or (iii) due to the director having attained mandatory directors’ retirement age. The stock options may be exercised for three months following termination for any other reason. The Directors’ Stock Plan also permits the donation of vested stock options, regardless of the date of grant, to family members and family trusts or partnerships. All outstanding stock options are fully vested.Plan.Plancompany’sboard discontinued the Directors’ Retirement Plan, was discontinued, and thewith all benefits previously earned by directors were frozen as of May 12, 1997.Under this plan, there is no benefit paid to a director who served for less than five years as of May 12, 1997. A director who had met the five-year minimum vesting requirement as of May 12, 1997 would receive an annual retirement benefit calculated as 50% of the director’s retainer in effect as of May 12, 1997, and a director with more than five years of service at retirement would receive an additional ten percent of such retainer for each year of service over five, to a maximum of 100% of such retainer for ten or more years of service. The annual retainer fee in effect as of May 12, 1997, was $30,000. The annual retirement benefit is paid for life.SheAs ofthe date the plan was frozen, andMay 12, 1997. Therefore she will therefore receive an annual benefit of $15,000.17 1220112013 Name Fees Earned or

Paid in Cash

($)(1) Stock

Awards

($)(2) Change in

Pension Value

and Nonqualified

Deferred

Compensation

Earnings ($)(3) All Other

Compensation

($)(4) Total ($) Rodney C. Adkins(5) 34,875 0 0 0 34,875 Linda G. Alvarado 96,500 33,363 0 0 129,863 Anne M. Busquet 98,000 33,363 0 0 131,363 Roger Fradin 93,500 33,363 0 5,000 131,863 Anne Sutherland Fuchs 105,500 33,363 0 5,000 143,863 S. Douglas Hutcheson 95,000 33,363 0 5,000 133,363 James H. Keyes(5) 40,875 0 0 0 40,875 Eduardo R. Menascé 119,000 33,363 0 0 152,363 Michael I. Roth 160,000 33,363 0 5,000 198,363 David L. Shedlarz 107,000 33,363 0 0 140,363 David B. Snow, Jr. 108,500 33,363 0 0 141,863 Robert E. Weissman(5) 40,875 0 0 0 40,875 (1) NameFees Earned orPaid in Cash($)(1)StockAwards($)(2)Change inPension Valueand NonqualifiedDeferredCompensationEarnings ($)(3)All OtherCompensation($)(4)Total ($)Mr. Adkins89,00054,26300143,263Ms. Alvarado90,50054,26314,5120159,275Ms. Busquet92,00054,26305,000151,263Ms. Fuchs93,50054,26300147,763Mr. Green(5)40,00000040,000Mr. Keyes115,50054,26300169,763Mr. Menascé92,00054,26300146,263Mr. Roth101,00054,26305,000160,263Mr. Shedlarz104,00054,26300158,263Mr. Snow87,50054,26300141,763Mr. Weissman92,00054,26300146,263(1)TheIn 2012, the Lead Director received an additional annual retainer of $10,000. Effective January 1, 2013, the Non-Executive Chairman receives an additional annual retainer of $10,000.(2) (2) On May 9, 2011,13, 2013, each non-employee director then serving received an award of 2,200 shares of restricted stock. The fair market value of the restricted share awards was calculated using the average of the high and low stock price, $24.78$15.40 and $24.55,$14.93, respectively, as reported on the New York Stock Exchange on May 9, 2011,13, 2013, the date of grant. The closing price on May 9, 201113, 2013 on the New York Stock Exchange was $24.74.$15.01. The grant date fair market value of the restricted stock awards was computed in accordance with the share-based payment accounting guidance under ASC 718.ASC718. The aggregate number of shares of restricted stock held by each director as of December 31, 20112013 is as follows: Mr. Adkins – 10,343 shares; Ms. Alvarado – 29,00033,400 shares; Ms. Busquet – 9,92214,322 shares; Mr. Fradin – 4,997 shares; Ms. Fuchs – 13,36317,763 shares; Mr. KeyesHutcheson – 24,0004,056 shares; Mr. Menascé – 18,99223,392 shares; Mr. Roth – 25,80030,200 shares; Mr. Shedlarz – 18,99223,392 shares; and Mr. Snow – 12,400 shares; and Mr. Weissman – 18,99216,800 shares. Stock options were not awarded to non-employee directors during 2011. Stock options formerly were available to non-employee directors as an investment choice under the Directors’ Deferred Incentive Savings Plan. Cash fees deferred with respect to plan years prior to 2004 could be invested in options to purchase common stock of the company. The aggregate number of stock options held by each director as of December 31, 2011 is as follows: Mr. Weissman – 1,789.2013.(3) (3) Ms. Alvarado is the only non-employee director who served on the board of directors during 20112013 eligible to receive payments from the now-suspendeddiscontinued Directors’ Retirement Plan. Ms. Alvarado is eligible to receive payments upon her retirement from the board of directors. The change in Ms. Alvarado’s pension value was ($10,710).(4) (4) Ms. BusquetFuchs, Messrs. Fradin, Hutcheson and Mr. Roth utilized the Pitney Bowes Non-Employee Director Matching Gift Program during 2011.2013. The company matches individual contributions by current and retired non-employee directors, dollar for dollar to a maximum of $5,000 per board member per calendar year.(5) (5) Mr. GreenAdkins completed his term as a director in May 2013, having expressed his preference not to be re-nominated. Messrs. Keyes and Weissman retired in May 2011.2013.13

Role of Governance Committee in Determining Director Compensation

In accordance with the Governance Principles of the Board, the Governance Committee reviews and recommends to the board of directors the amount and form of compensation to non-employee members of the board of directors. The Governance Committee reviews the di-

rector compensation policy periodically and may consult from time to time with a compensation consultant, to be selected and retained by the committee, as to the competitiveness of the program.

Revised Director Compensation Program

The Governance Committee undertook a review of director compensation in 2013. The compensation for the board of directors was last modified in 2007. The Governance Committee retained an independent compensation consultant, Farient Advisors, to assist in its review. Farient provides no other consulting services to the company.

Farient presented a recommendation to the Governance Committee for changes to the board of directors compensation program, based upon an extensive analysis of comparative data, including director compensation at companies in the peer group used for executive com-

pensation purposes. Farient concluded that the company’s director compensation was below market, particularly in the equity component of the program, when compared with the peer group and the broader benchmark of comparably sized companies.

Based upon its review, including the information Farient provided, the Governance Committee recommended that the board of directors approve changes to the director compensation program. The Governance Committee recommended that the compensation level be set at about the 50th percentile of the total compensation in the peer and broader benchmark groups. The board of

| 18 |

CORPORATE GOVERNANCE

directors approved the changes to the compensation program, subject to the approval by our stockholders of an amended and restated Directors’ Stock Plan. No new

shares need to be authorized to satisfy awards under the amended and restated Directors’ Stock Plan.

A comparison of the current directors’ compensation program and the new program is shown in the table below.

COMPARISON OF CURRENT AND NEW DIRECTOR COMPENSATION PROGRAMS

| Incremental Leadership | ||||||||||||||||||

| Board Member | Premiums | |||||||||||||||||

| Compensation Element | Current | New | Current | New | ||||||||||||||

| Board service | (Board Chairman) | |||||||||||||||||

| Cash retainer | $65,000 | $75,000 | $50,000 | $100,000 | ||||||||||||||

| Meeting fee | $1,500 | $0 | $0 | $0 | ||||||||||||||

| Equity Award | 2,200 shares | $100,000 | ||||||||||||||||

| Annual Equity Grant | value-based grant | |||||||||||||||||

| Committee service | Committee | |||||||||||||||||

| Cash retainer | Chairmen | |||||||||||||||||

| • Audit | $0 | $12,000 | $0 | $12,000 | ||||||||||||||

| • Executive Compensation | $0 | $10,500 | $0 | $10,500 | ||||||||||||||

| • Governance | $0 | $9,000 | $0 | $9,000 | ||||||||||||||

| • Finance | $0 | $9,000 | $0 | $9,000 | ||||||||||||||

| Meeting Fee | ||||||||||||||||||

| • Audit | $1,500 | $0 | $2,000 | $0 | ||||||||||||||

| • Executive Compensation | $1,500 | $0 | $1,500 | $0 | ||||||||||||||

| • All Other Committees | $1,500 | $0 | $1,500 | $0 | ||||||||||||||

| Total Compensation | @$125,000 | @$195,000 | ||||||||||||||||

| Ownership Guidelines | 7,500 shares; | 5 times cash retainer; | ||||||||||||||||

| 5 years to reach | 5 years to reach | |||||||||||||||||

| compliance | compliance | |||||||||||||||||

Highlights of the Revised Directors’ Compensation Program are:

| • | Cash component will be paid as annual retainers rather than as a combination of a retainer and meeting attendance fees | |

| • | Leadership premiums will be paid to Committee Chairmen rather than as a higher meeting attendance fee | |

| • | Increase in leadership premium for Chairman of the Board | |

| • | Annual equity grant will be in the form of restricted stock units, the number of which is to be calculated by dividing $100,000 by the fair market value of share of the company’s common stock as of the award date | |